By Jan Valkhof and Robert Driessen in DEAL! (This article is based on the previously published article and updated with recent data)

Buyers: The facts are there for the taking! Negotiating is inherent to buying, but does that mean that all buyers are good at it? And, if so, what is the quality of this competence based on?

The ritual mating dance

Experience shows that most negotiations still start from a defective preparation with meaningless goals like ‘let’s see how I can get the price as low as possible’. This is strange because nowadays we have all the information to perform a good and professional fact-based negotiation. Try to stay away from the most painful part of the process; the margin. There are at least 15 other cost drivers that could be the topic of your conversation. Think about the (development of) commodity prices, energy, wages, stock, and transport. But also office costs, overhead, waste processing, location of production, and the depreciation of buildings and machines.

Soon, everyone can see everything

How amazing, professional, and righteous would it be to do business based on transparent data? Unfortunately, because this still feels like a disadvantage for the selling party, it is an exception to see negotiations with open-book calculations. But all this data is available and it is just a matter of structure and interpretation. Many industries are way ahead. Just look at the financial industry, the medical sector, and leading online companies. Everything is data. The bank has become an IT company, computers mutate data and algorithms predict my needs before I even know I have them. Procurement is late, but the digital transformation has finally made its appearance. This results in an improvement of processes and structure, but there is one discipline that is stuck behind: should-cost.

What is should costing?

Literally: what should something cost? There are several ways to get insight into a cost price. The most simple way is to ask your supplier. “Hi partner, show me how your cost price is structured. Together we will try to see if it can be done more efficiently. We both take responsibility for the supply chain and we both gain something. And if we can’t improve anything, at least we have insight into each other’s businesses which creates better understanding.” But okay, if this doesn’t work, the buyer can make his calculation. Should costing is possible in two ways: bottom up or top down. The most common way is starting bottom up with a blank piece of paper. What things are part of manufacturing a specific product? The analyst will study the process and the market, gather data, and calculate and simulate. Depending on the complexity of the product, such a study can take several days to several weeks. Regular buyers rarely have the time to do this. Besides, it also requires some competencies to build a good cost analysis. In reality, bottom-up should costing is often only applied by very passionate professionals (=positive) or external advisors (=expensive). This is why WTP (What’s The Price) has tilted the process and performs top-down should costing. It helps to simulate a product (development and cost models) within a few minutes. It’s a matter of combining the right data and subsequently letting the software do its work to determine the cost.

WTP uses four databases:

- 3000+ commodities / raw materials

- 360+ industry price/cost structures form 260.000+ annual reports

- 160+ countries covered for labor and energy rates

- 155 currencies supported

Within the software, a user can then fill in four things:

- What industry manufactures my product?

- What country manufactures my product?

- What are the most important commodities in my product?

- What is the weight of these commodities?

As soon as a buyer has (part of) this information, simulating the cost price only takes a few minutes. Disclaimer: we are talking about direction and not perfection. Experience shows that the simulation approaches 90 percent of the actual cost price.

Why should costing?

Savings that are caused by should costing, are in no way comparable to traditional negotiation results. Fact-based arguments are incredibly strong and almost impossible to disprove. This ensures short-term or immediate results. Here are three examples:

Case 1: a pillow from China for an interior shop

An interior shop outsources the production of pillows to China. The wages in this industry are relatively low so a shift towards different countries with lower wages will probably yield little. The focus should be on the choice of material because this determines 58% of the cost price. The average profit margin within this industry is fair: an EBIT (earnings before interest and tax) of almost 19%.

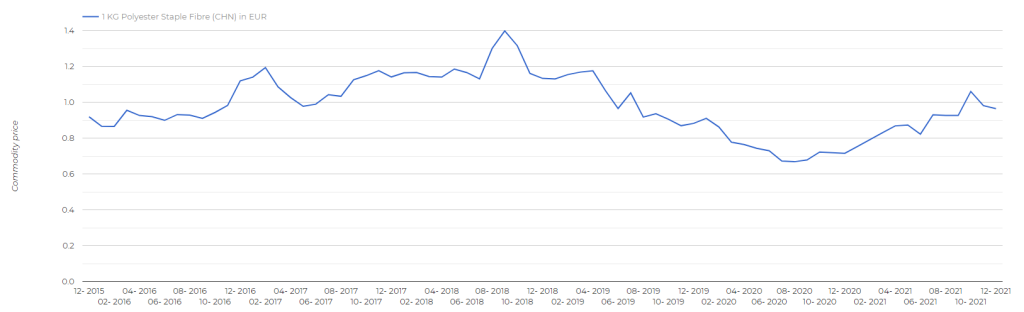

If we look at price development, the following is noticeable: commodity prices have dropped 20% since 2015. Because commodities determine 58% of the cost price, the price should be 12% lower. The polyester cover represents €1,36 of the total material costs of €1,57; so basically the buyer just has to follow this material.

Source: WTP should costing tool

Let’s say we make the cover slightly thinner by using 45S instead of 60S and we buy our fabric in China instead of Pakistan. In my pillow, this can make a difference of a whopping €0,15. This is 10% material cost and a 5,8% decline in the total cost price. This department store buys 126.000 pillows a year and has a saving of €18.900 within reach.

Companies spend an average of 45% of their production costs on materials. The remaining 55% goes to profit and other costs. Needless to say, the differences between industries are huge. For example, in the production of pleasure articles like tobacco, syrup, and distilling liquor, ebit reaches a percentage above 60%! On the contrary, hardly any money is earned in slaughterhouses. The cost share of the animal determines 80% of the cost price. So when the buyer makes a mistake and the meat processor is stuck in a large contract with a retailer, this has a huge impact…

Case 2: A metal valve for water distribution

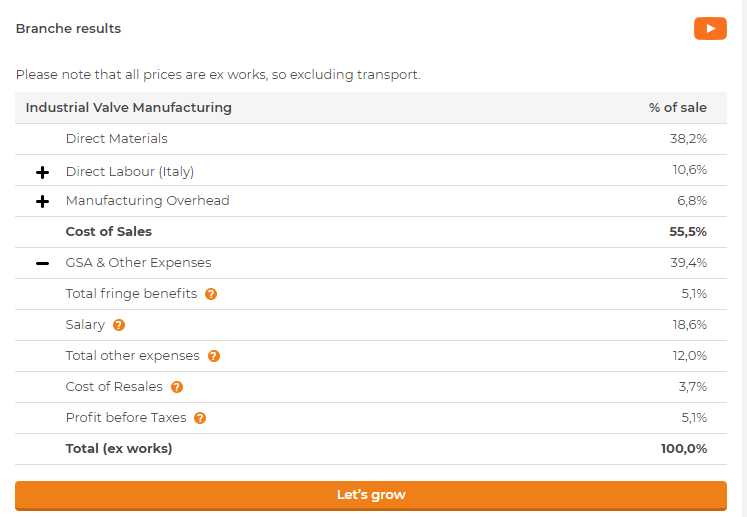

Within the industry of ‘industrial valve manufacturing’, 38% of the price is determined by the material. Many price increases are substantiated by commodity price increases, but in this case, the impact of a price modification is only slightly more than a third. The impact of wages on the contrary is very high. Production-related earnings in Italy represent 11% of the cost price in this industry and the other staff represents another 18%, so together 29%.

Average cost price structure in the ‘industrial valve manufacturing’ industry.

Let’s say the same production process takes place in Poland, then wages represent just 7% of the cost price. That is a difference of 14% compared to Italy. Within this industry, the buyer is better off focusing on location than the development of commodity prices. In this example, production in Poland leads to a potential decrease of €15 per valve. That reduces the price by 24%. For a technical wholesaler that buys 1.500 of these valves, this means saving €22.500. Another noticeable thing is that the average ebit in this industry is quite high, at 27%. The negotiation can be started with a little less compassion.

If we focus purely on wages, Norway is the most expensive country to produce. They have an average hourly rate including secondary conditions in production above $60. Switzerland and the other Scandinavian countries pursue an average hourly rate between $40-$60. The Netherlands is slightly above America and Canada with $40. On the bottom of the list is India, still 40% lower than China. Hourly rates in the countries in Eastern Europe are three times higher than in the Far East, but a country like Taiwan is more expensive than Poland.

Case 3: a semi-professional video camera

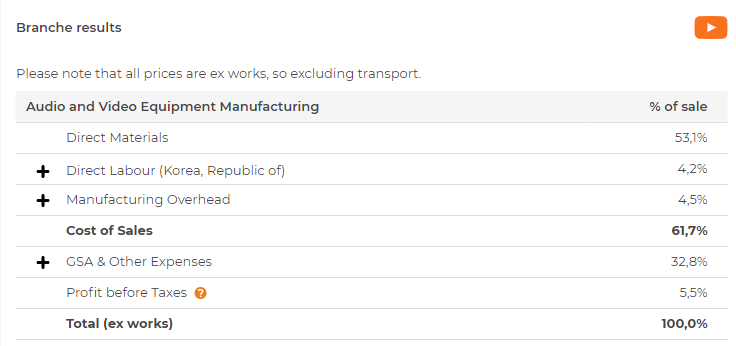

In the AV industry, material costs determine 53% of the cost price. Other than commodities it consists of bought components. An important part of the costs is fixed: depreciation of buildings and machines, R&D, and overhead. The percentage of fixed costs in the cost price is 37,3% (Overhead +GSA)

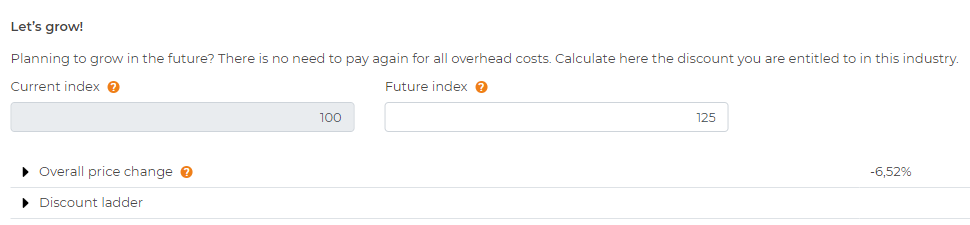

This means that the buyer’s volume has a large impact on the cost price. Many elements are fixed and the variable costs are relatively irrelevant. In this case, the buyer should focus on the development of buying volume or bundling volume. Labor costs (4,2% in Korea) are less relevant in this industry. If you increase your buying volume from 100 to 125 cameras, you can appeal to a price decrease of 6,5%. Your growing buying volume doesn’t make the manufacturer build another factory, a lot of costs stay the same. You contribute more to fixed costs and should therefore benefit from the volume advantage. In this case, the benefit is quite sufficient.

Source: WTP should costing tool

Simulation growth based on fixed and variable costs within the AV equipment industry

Assuming 70% of the overhead costs are fixed and 90% of GEA, we’re talking about €50 benefit. Your price decreases from €691 to €641. For this buyer, we’re talking about saving €6.250. Volume is often underestimated in a negotiation. Regularly there is a contractual growth bonus, but this bonus is about promilles rather than percentages. This is in addition often only applied to the extra volume and not to the total volume. Most of the time, you can assume that when material costs and labor costs are low (or the other way around: development costs and overhead are high) volume has a large impact on the price.

What to do next?

Let’s turn it around: what reasons could there be to not use data and start fact-based negotiating:

- The buyer doesn’t have information

- The buyer doesn’t have time

- The buyer is not that analytical

- The buyer doesn’t dare to confront the supplier with facts

The first obstruction is solved by smart software. And because there is little time for preparation and data collecting (point 2), the challenge is within classic time management: the shifting of priorities from operational to tactical, enlarging capacity, asking for help, and learning how to delegate. Within the case of points 3 and 4, the buyer has a different challenge. These points mean it’s time to ask yourself the question if buying connects with your competencies. A procurement professional owes it to the specialty of buying and owes it to their employer to use fact-based data as a priority within his/her job.